When we talk about relationship abuse, we typically focus on physical and emotional mistreatment. But financial abuse or the control of one’s ability to acquire, use and maintain money by an intimate partner occurs in up to 99 percent of domestic violence cases.

So, why aren’t people talking about it?

For starters, this silent form of abuse is not easily recognized. It begins with small offenses that slowly become more controlling overtime. This may involve a partner insisting they handle finances without your input or demanding you stop working altogether. Though limiting your ability to earn money is not the only way abusive partners exert control. They may also limit your access to “anything you haven’t paid for, like a car or other basic necessities,” Jennifer White-Reid, Vice-President of Domestic Violence Programs at the Urban Resource Institute, told Bustle.

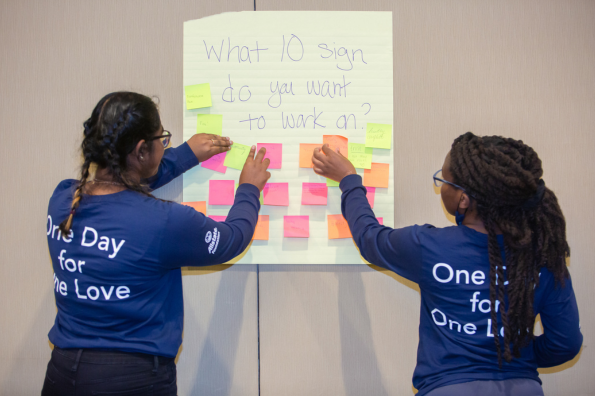

Recognizing The Signs of Financial Abuse

Financial abuse can vary from situation to situation since there isn’t one way to handle money in a relationship. This makes identifying abusive tactics all the more difficult, as abusive partners may argue that “this is just how the relationship works.” Still, there are concrete tactics abusive may use to keep their partner trapped.

You are in a financially abusive relationship if your partner…

- Gives you “allowances” or “budgets” without your input

- Requiring you to account for everything you spend

- Pressures you to quit your job or sabotages your work responsibilities

- Feels entitled to your money or assets

- Spends your money without your knowledge

- Controls how all of the household finances are spent

- Limits your ability to attend job training, pursue higher education, or otherwise advance your career

- Limits your access to your own bank account or mutual bank accounts

- Lives in your home without working or helping with household tasks

- Maxes out credit cards in your name (and then doesn’t make payments on those credit cards)

- Threatens to cut you off financially when you disagree

- Uses funds from children’s savings account without mutual agreement

- Prevents you from working by hiding your keys, or offering to babysit and then not showing up

- Engages in other forms of abuse like belittling or physical abuse when they get angry over your spending habits

The Impact of Financial Abuse

The impact of financial abuse can be felt long after you’ve left an abusive situation. Kim Pentico, director of economic justice programs for the National Network to End Domestic Violence (NNEDV), said financial abuse is “devastatingly effective because it’s often not illegal.”

A person who maxes out their partner’s credit card and refuses to make payments ruins that person’s credit and ability to find housing, purchase a vehicle, or obtain student loans. And without access to economic resources, survivors often face a new set of challenges to their safety and long-term security.

Talking About Financial Abuse

A study by the Allstate Foundation found that only 3 percent of Americans thought financial abuse would likely cause long-term effects compared to emotional (43 percent) and physical abuse (22 percent). Yet financial abuse remains the number one reason people return to toxic relationships.

So how can we as a community work to bring awareness to financial abuse? As with most things, it starts with a conversation. Christine Hennigan, a financial analyst, and advocate for women’s financial literacy says it can be uncomfortable for most people to talk about money, but it’s an imperative first step to recognizing abusive situations. An honest, non-judgmental conversation with someone you trust can help people realize they’re being financially controlled.

Responding to Crisis

Leaving a toxic relationship is not just emotionally draining–it can also be life-threatening. In fact, the most dangerous time of an abusive relationship is post-breakup. In moments of crisis, it’s difficult to think clearly, creating a safety plan in advance will help protect you and your loved ones. Reach out to a domestic violence advocate before leaving an abusive partner to prepare a safety plan or personalized strategy for exiting a toxic relationship. A domestic abuse coordinator can also connect you to other resources including legal help, counseling and safe houses.

When preparing to leave a toxic relationship make copies of your financial data like credit cards and financial statements if it’s unsafe to take the originals. This will be useful later in proving who owns what. Keep this documentation in a safe place where your toxic partner can’t access it until you’re able to safely leave the relationship.

Contact the National Domestic Violence Hotline 1-800-799-7233 if you believe you are in a financially abusive relationship.

Browse by Category

Don’t Be on the Naughty List: Spotting Unhealthy Relationship Signs This Holiday Season

The holidays are meant for joy, connection, and celebration—whether it’s Christmas, Hanukkah, Kwanzaa, or cozy winter vibes. But if someone…

How to Have Healthy Holiday Conversations with Family (and Prep Your Partner)

The holidays are a time for family, good food, and—let's…

Finding Strength in Our Stories: Domestic Violence Awareness Month

⚠️ Trigger Warning: This blog includes content and language related…

Understanding Domestic Violence Awareness Month (DVAM)

October is almost here, and that means it’s time to…

4 Students Share How They Helped a Friend in an Unhealthy Relationship

Watching a friend struggle in an unhealthy or abusive relationship…