It’s that time of year again! Between office parties and frosted sweets, the holidays are an awesome time to reconnect with old friends while getting to know new ones. Sounds great, right? Wrong. Once you add tempting sales and gifts (for literally everyone you know) the holidays can feel overwhelming, especially if you have a budget conscious S.O. Financial strain is a leading cause of tension in relationships – and it’s no surprise that money and stress go hand in hand during this time of year.

According to a survey by SunTrust Bank, 35% of all respondents experiencing tension in their relationship said that money was the primary cause and about 47% of the respondents claimed their partner had different saving and spending habits than they did. Don’t want to be a statistic? Great! It may be time to pull together a financial plan that keeps you and your sweetie’s spending on track.

Because there are some problems that even mistletoe can’t fix we’ve gathered a few tips to help you avoid financial strain in your relationship this holiday season.

Set Expectations Together

The holidays are an exciting time to splurge on gifts for friends and family. However, your partner may have different ideas about appropriate spending than you do. Sit down and talk through expenses for the holidays. Create a budget for your finances and stick to it. It may even be helpful to set a spending range or limit on gifts for each other.

Keep in mind that expectations can’t be met unless they are clearly laid out and both partners fully understand them. Making plans ahead of time is so important in avoiding financial strain, as it reduces the chance of disagreements over unexpected spending. Simply being on the same page as your partner can make a world of a difference in avoiding tension in your relationship.

BONUS TIP: Make gift-giving fun by agreeing to a theme or choosing to exchange homemade gifts!

Choose Alternatives to Spending

If you are on a tight budget that causes you stress consider other gifting options! Here’s how:

- Make a low-cost meal rather than spending money on an expensive meal out

- Choose a “Secret Santa” or “White Elephant” approach to gift-giving

- Spend a day volunteering instead of paying for an activity

- Explore the great (free) outdoors!

- Host a New Year’s Eve night in rather than spending a ton on an extravagant party

Remember that you don’t have to spend money to have fun! There are plenty of holiday activities that won’t break the bank such as caroling, holiday decoration viewing and a cozy movie night – take advantage of them.

BONUS TIP: Turn a fun, free activity into a holiday tradition!

Plan Ahead for Next Year

In January think about what worked and what didn’t. Talk through how you feel about your financial situation once the season has come and gone. This can help you to continue these financial best practices throughout the rest of the year, too!

Honesty is one of the most important factors in a healthy relationship, and it’s absolutely key to feel comfortable when telling your S.O. what makes you uncomfortable about spending habits that impact your relationship.

BONUS TIP: Work your financial plan into a New Year’s resolution!

Browse by Category

Don’t Be on the Naughty List: Spotting Unhealthy Relationship Signs This Holiday Season

The holidays are meant for joy, connection, and celebration—whether it’s Christmas, Hanukkah, Kwanzaa, or cozy winter vibes. But if someone…

How to Have Healthy Holiday Conversations with Family (and Prep Your Partner)

The holidays are a time for family, good food, and—let's…

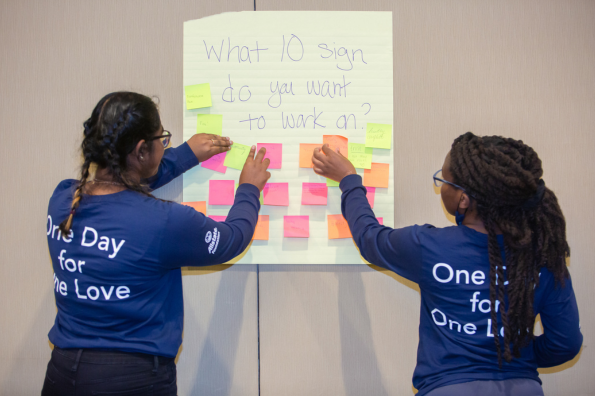

3.2 Million Strong: How One Love is Saving Lives Through Education

Please share this blog with your network across social media,…

Finding Strength in Our Stories: Domestic Violence Awareness Month

⚠️ Trigger Warning: This blog includes content and language related…

Understanding Domestic Violence Awareness Month (DVAM)

October is almost here, and that means it’s time to…